Alyssa Powell/Insider

- CAGR stands for compound annual growth rate, and it is a measure of an investment's average past performance over a long period of time.

- CAGR doesn't predict how an investment will perform in the future.

- CAGR has its limitations and doesn't necessarily reflect an investment's actual performance.

- Visit Insider's Investing Reference library for more stories.

By their very nature, markets fluctuate constantly, making it difficult to know which investments are worth sinking your money into. While there's no way to reliably predict what's going to happen in any given market, there are some indicators that can give you an idea of what opportunities might be worth exploring.

Compounded annual growth rate (CAGR) is one such measure. Here is a closer look at what CAGR is and what it means in terms of investments.

What is compound annual growth rate (CAGR)?

CAGR is a formula that calculates how the value of an investment has changed over the course of a specific time period, assuming all earnings have been reinvested and no deductions have been made. This calculation allows investors to look at how much an investment has gained or lost over one or more years as a way to determine overall performance. It's a useful tool for comparing multiple investments to see what might be worth buying into, whether it's securities, property, business, or anything else of value.

How CAGR works

CAGR is calculated by looking at the initial and final values of an investment and a period of time over which to evaluate performance. This formula is relatively simple and assumes that nothing has been deducted from the investment, such as a sale of shares. It also assumes that any value earned – through interest or dividends – has been reinvested and compounded into the investment.

"The CAGR measure can be used in any industry," explains Daniel Garza, Chartered Financial Analyst and Senior Research Analyst with Intercontinental Wealth Advisors. "However, it can be used in the investment world to complement other widely used measures, such as time-weighted return. This is because some assets are not publicly traded and it's harder to know their value at a specific time every month/year to evaluate growth or rate of return."

Garza says that CAGR is useful when applied to assets that don't have publicly available data to determine performance, such as property or physical assets.

"This is because having an initial value for a physical asset and a final value for the same asset, regardless of the time frame, allows you to calculate it," he says. "There is no need to constantly know the value of this asset to get to CAGR."

CAGR formula

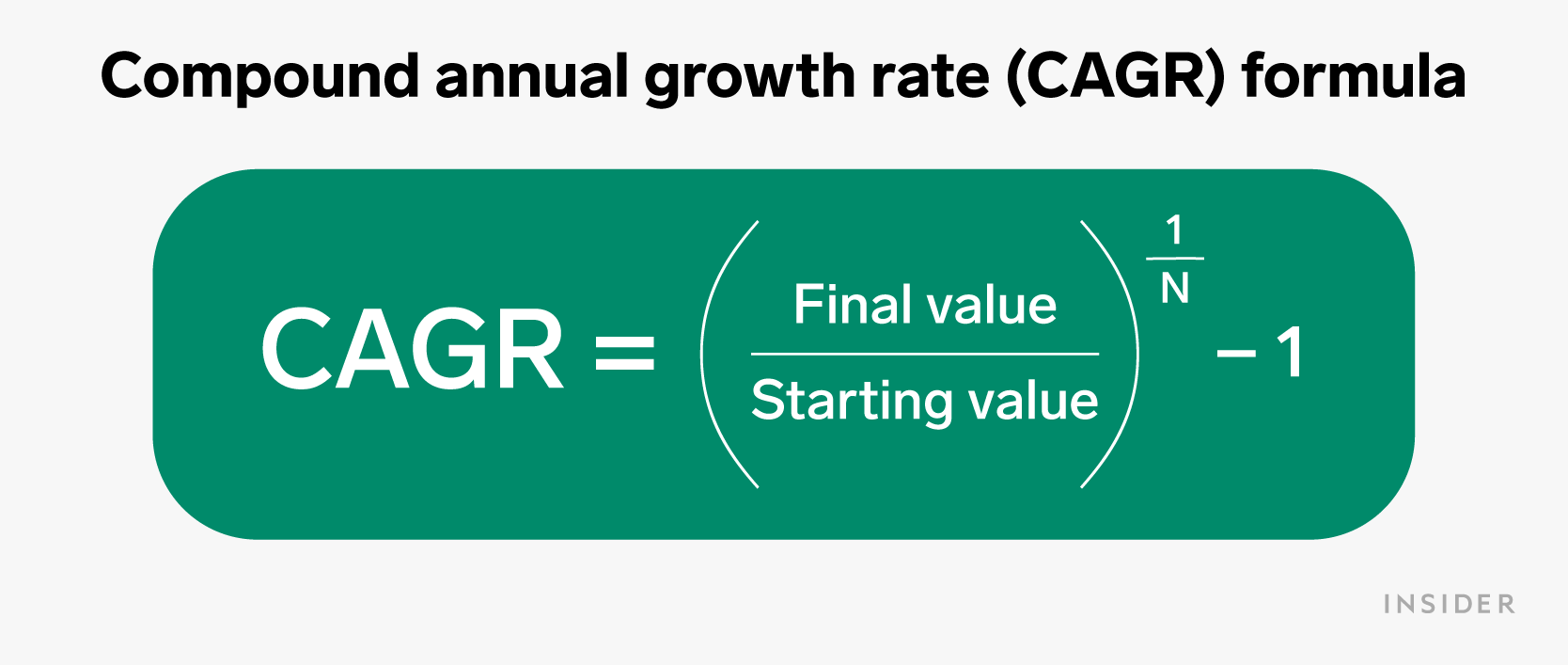

To calculate CAGR, use the following formula:

Alyssa Powell/Insider

- Divide the final value of an investment by its starting value.

- Apply the exponent of 1/N to that quotient. The value of N will be the timeframe you're evaluating, such as a number of years.

- Finally, subtract 1 from the value you get from applying the exponent.

Let's see how this works when you put it all together. To keep things simple, we are going to determine the CAGR for an investment that has grown from $100 to $108 in value over 5 years. Your formula would look like this when you plug in all of the values:

CAGR = (108/100)/^⅕ -1 = .015511 or 1.5511%

This tells us that on average, the investment gained 1.5511% in value each year during the selected five-year period. Some years may have seen more growth and others less. But it smooths out to this rate when you look at the timeframe as a whole.

How investors use CAGR

One of the most common reasons investors use CAGR is to compare investments. Though you're not seeing the actual gains and losses from year to year, CAGR shows you how an investment has historically performed. You can use this information to learn about one or more investments, see how they measure up to one another, and make informed decisions about where you want to put your money.

You can also use CAGR to track business performance as a result of measures a company takes, such as policy changes or new products introduced to market. It can also give you an idea of a business' strengths and weaknesses. For example, a CAGR that shows a steady decline over a number of years might indicate that internal or external issues are impacting profitability and the business is struggling to overcome them.

Disadvantages of CAGR

- CAGR doesn't tell you anything about an investment's risk. It's simply a measure of past performance. It doesn't account for varying degrees of risk that all investments are vulnerable to. If you want to determine the risk-return reward of an investment, you can use other calculations, such as Sharpe's Ratio and Treynor's Ratios, both of which adjust for risks that CAGR doesn't.

- CAGR is a "smoothed" value, meaning it doesn't show the history of highs and lows an investment has seen. Growth is assumed to be constant throughout the given timeline, even though that's not necessarily the case.

- CAGR can't predict how an investment will perform in the future. You can look at past performance and make a guess as to whether or not an investment is likely to continue that pattern of growth. But it is in no way a guarantee, no matter how steady growth has been in the past. In fact, Garza says the shorter the time frame used in your analysis, the less likely it will be that the expected CAGR performance will be repeated.

- Representation of data can be limited when you're talking about CAGR because you're only looking at performance during a specific time frame. There can be a lack of context that skews interpretation of CAGR. For example, if you're looking at stock that was hit hard during a recession and experienced rapid growth in the years recovering from a significant loss, the CAGR is going to seem overly high. That rate of increase will most likely slow as the company levels out.

CAGR vs. internal rate of return (IRR)

CAGR is a simplified, overall look at past performance. The internal rate of return (IRR) calculation takes more factors into consideration than starting and ending values over time. It looks at inflows and outflows of cash and multiple time periods. If you have added to or taken out money from the investment, using IRR is a better measure of return rate.

| Compound annual growth rate | Internal rate of return |

|

|

The financial takeaway

Looking at the CAGR of an investment can be useful in evaluating past performance. Because it assumes that growth is consistent from year to year within the evaluation period, it may not accurately reflect the volatility an investment experienced. It's a smoothed average that doesn't tell the whole story but can be used to quickly compare how different investments stand up to each other.

You'll find CAGR applied to all kinds of industries and to just about anything of value. Make sure to fully understand the context of how CAGR is calculated so you can make an informed opinion about what it means for your goals.

And remember that while this average uses data based on events that have already taken place, it is not necessarily an accurate predictor of how an investment will perform moving forward. View it as one of many data points in your larger research about opportunities you're interested in investing in.